Executive Summary

Looking Back On 2024: Markets soared 26% in 2024, fueled by AI and Big Tech. Will this stellar performance continue next year?

The Bull Case: Bulls anticipate transformative AI, driving productivity gains and sustained equity growth. But will this AI be deployed quick enough?

The Bear Case: Bears warn rising national debt and interest rates could choke tech optimism.

What I Think: I remain long term bullish on equities, but I think modest gains are more likely given US debt headwinds.

Personal Thoughts & Reflection: With 12 months of running the fund on my own under my belt, I’m grateful for our research’s impact and excited about AI’s generational potential (both as an investor and as a researcher).

Looking Back On 2024

After a strong 2023, markets here in the US have delivered an impressive 26% performance YTD (not including dividends) on the back of strong rallies in Big Tech and a wave of AI optimism that’s given investors a ton of reasons to be bullish.

2024 really has been a year of AI and how it can impact businesses. I wrote about this last year in June. I think it's always been about how AI can impact “boring companies” not just flashy names like Nvidia.

What’s key from here is what happens next? If we look back at annual S&P 500 performance since the 1920s, we can see that it's rare for the S&P 500 to put up more than 2 years in a row of 20%+ performance.

Yet, the market continues to be incredibly bullish on AI. Some analysts (such as Wedbush’s Dan Ives) think we are just in the beginning stages of a multi-year AI bull market.

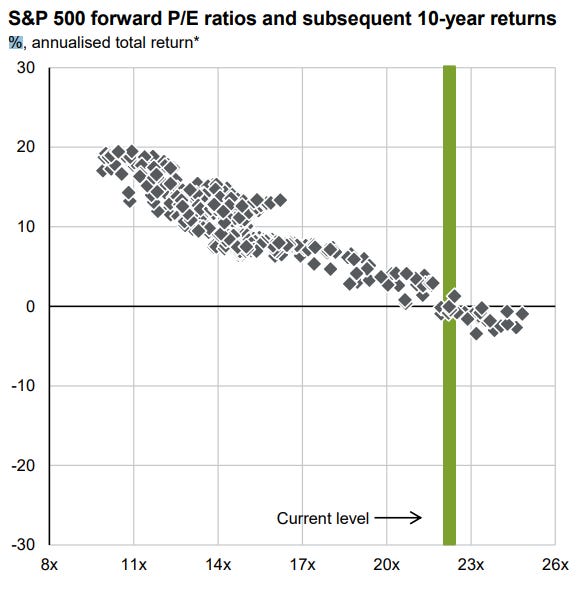

He might be right. Or he might be wrong. Based on current forward P/E ratios historical data tells us that forward returns should be close to 0% annualized for the next decade.

So with top Wall Street analysts and historical data at odds, the time-tested question emerges:

Is it different this time? Are we really in a new era of stock market returns driven by AI?

I think this is the (literally) $55 Trillion question. The purpose of me writing this isn’t just to tell you which way I think.

It's to show you what assumptions have to come true for bulls (or the bears) to be right.

The Bull Case

Imagine this: over the course of the last 2 years, AI has helped lift the US stock market out of its bear market lows in late 2022 (on the back of ChatGPT) and helps investors realize that game changing technology is around the corner.

While there have been multiple ‘this time is different’ events in the stock market over the last 232 years of stock trading here in the US, I think this current run up (and in some cases excessive valuations) can be most likened to the Dot-com bubble of 2000.

Back in 2000 (and now) investors have become increasingly bullish that a bleeding edge technology (then it was the internet, now it’s AI) is on the verge of bringing a huge wave of productivity gains here in the US that will allow US workers to earn more, spend more, and increase their overall quality of living.

Generally, technology advancements are the foundation of an expanding capitalist economy. Bulls argue AI is no different. Bulls believe it’s being adopted far faster than other key technological advancements.

So, the main question here (if you are bullish): is AI really making people more productive? And are AI model capabilities growing faster than investors expect (will there be a positive surprise)?

I actually think both are possible.

Starting with productivity, there's a really solid case that AI has changed the game and already started to make workers here in the US far more efficient.

Recent analysis from the WSJ shows that AI is likely a contributing factor in the massive acceleration in productivity here in the US. After productivity gains bottoming in early 2016, US workers have become more productive each year for almost 10 years (with the exception of the COVID whiplash between extreme productivity growth and then decline).

This has huge implications on why real wages have increased over the last 10 years (net of inflation).

I’ll talk about this more later in the bear case, but increased productivity is a key part of us fighting off one of our biggest risks (our rising national debt).

So if workers are getting more productive and this is helping them earn more, are AI models increasing at a rate that allows them to be even more valuable next year than they were this year?

In this case, I think the answer may also be yes as well.

For this, we need to understand what AI proficiency looks like.

AI models are proficient based on a series of ‘benchmarks’ that independent researchers evaluate the models on to determine how valuable they are in key tasks like writing, scientific research, or math.

AI models have been getting better over the last 12 months, but for this AI driven rally to have any chance of powering higher, I think models have to get exponentially better.

Fortunately, they have.

Two weeks ago, leading AI lab OpenAI released its results of their newest LLM (o3) that completely blew the industry out of the water in terms of reasoning capabilities for LLMs. The key test the model was tested on (Arc AGI test) showed a huge improvement in reasoning capabilities. OpenAI’s new model (o3) is a game changer in that it gets closer to the 100% mark than any other model that’s come before it by a wide margin. 100% is roughly equivalent to human level reasoning. This model has a lot of use cases.

OpenAI’s new model is set to come out for public release in February. The question is: is this enough to keep productivity growth accelerating, the economy strong, and tech stocks moving higher in 2025?

I think the answer isn’t clear just based on test results. Strong AI models in a lab are one thing, practically applying them is a whole different arena.

The Bear Case

On the other hand, the biggest bear thesis from here is the US national debt.

I wrote about this back in September of 2023. My concern then (and now) is that as US debt balloons, this rate cutting cycle by the Fed would not result in the same decline in interest rates that investors have been accustomed to with previous Fed rate cut cycles.

While the dataset is small (just since mid-September) the trend is clear for 10yr Treasuries: yields are going up even as the Fed cuts rates.

The prevailing thesis in the market is that the rise in 10 year interest rates is a function of reaccelerating inflation risk. However, I think the bigger culprit is the ballooning debt.

If we’re near our fiscal limit, the effects for stocks could be catastrophic. Rising risk free rates (10 year yield) means investors have less appetite for risk on assets (such as some AI tech stocks).

If 10 year yields keep rising, (which as I wrote on in January there is an argument that they could even as the Fed cuts rates) tech stocks could suffer if growth doesn’t beat to the upside.

2022 is a solid recent example of what happens when interest rates jump quickly. Tech stocks (and in turn the overall market since it's heavily weighted to a handful of tech stocks) could suffer.

What I Think

Overall, in the long run, US stocks (on the whole) have been one of the single best asset classes in the history of humanity. I feel confident in 5 years that stocks (in an overall index like the S&P 500) will be higher than they are today.

The main question: will tech stocks (powered by their latest AI models) power higher in 2025 and offset the rise in 10 year yields.

I think in some cases it's possible, but don’t expect 20%+ returns like we have seen for the last few years. There are a few companies that I think are exceptions to the rule (Palantir being one of them). But many tech stocks (and therefore the overall market) have huge growth assumptions they have to meet in 2025 in order to justify their valuations. It's an uphill battle. Our growing US debt will make it even steeper.

Now, I don’t think that means trying to time the market. I think it means own equities that have reasonable valuations, a strong path for growth, and can surprise to the upside in 2025.

In essence, the classic GARP (Growth At a Reasonable Price) equity. Every stock has a down year from time to time. But GARP equities are all weather. It's where I like to invest. I think they’ll do well in 2025 as well (whether relatively against a down market or in absolute returns).

Personal Thoughts & Reflection

It's now been 12 months since I took over the reins of Noah’s Arc on my own. Over the last twelve months, I’m proud of the 250+ pieces of research we’ve been able to write across 4 platforms.

Our research has reached 1.1 million viewers, and 4,000+ people have been generous enough to subscribe and follow along (across all platforms).

On top of this, our investment opinion pieces (when collectively benchmarked against all other publicly available research) consistently rank in the top 3-4% of all publicly available research globally.

Every day I am grateful for the privilege to wake up, research companies where I think their stories are incredible, and then take actions based on our insights.

In 2025, my hope is to do even more of this. AI is a once in a generational opportunity to get involved in (as an investor), and to research it.

Best wishes to 2025. Once again, Go Blue!! Beat Bama.

Noah

No aspect of this material is intended to provide, or should be construed as providing, any investment, tax or other financial related advice of any kind. You should not consider any content herein or any subsequent services provided to be a substitute for professional financial advice. If you choose to engage in transactions based on the content herein, then such decision and transactions and any consequences flowing therefrom are your sole responsibility. Noah’s Arc does not provide tailored investment advice to any person directly, indirectly, implicitly, or in any manner whatsoever.