Welcome to Noahs’ Arc Q4 Newsletter. This time we’re focusing on operating in Chaos.

No aspect of this material is intended to provide, or should be construed as providing, any investment, tax or other financial related advice of any kind. You should not consider any content herein or any subsequent services provided to be a substitute for professional financial advice. If you choose to engage in transactions based on the content herein, then such decision and transactions and any consequences flowing therefrom are your sole responsibility. Noahs’ Arc does not provide tailored investment advice to any person directly, indirectly, implicitly, or in any manner whatsoever.

Executive Summary

Smoothing Chaos - With such a chaotic year, it’s important to hone in on the power of compounding when you smooth out the drawdowns.

Convexity in Chaos - One of our copper mines has exposure to Peru; while this initially sounds problematic due to the current unrest, the company’s asymmetric exposure to copper prices makes it a more interesting proposition.

Seeing Through Chaos - We’re announcing our new joint venture, Ultima Insights! We are leveraging technology to increase our ability to find meaningful data points impacting our portfolio.

Smoothing Chaos

A lot has happened this year, and not a lot of it has been great news for markets. Inflation, interest rates, Ukraine, Omicron, Pakistani flooding, food shortages, and droughts, oh my!

Markets have been choppy. Very choppy! However, our fund has ended its first calendar year down just over 2% (net of fees) since inception. To put that into perspective, the S&P 500 dropped over 15% in the same time frame. (This statement was edited upon completion of our December accounting.)

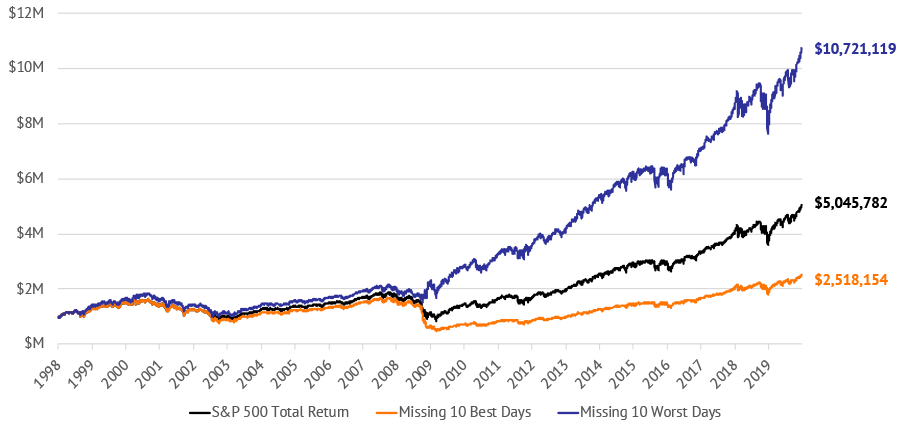

An interesting study that we’ve mentioned to a few of you in person: if you were to invest a million dollars into the S&P 500 in 1998 and miss the 10 best days in the market, you’d have earned about half of what you would have earned by simply buying and holding. On the other hand, if you missed the ten worst days, you’d have twice what you would have earned by simply buying and holding.

We’re not going to pretend that we can dodge every down day for you, but a lot of our efforts go into attempts to mitigate that downside. We believe it's more important to outperform on the downside than it is to outperform on the upside. And while, on the other hand, we won’t be able to capture all of the upside, we’re willing to make that sacrifice for a bit of added security.

The core bet of our fund is that by staying nimble and outperforming on the downside, we can take advantage of cheaper prices in the names we love. Most interestingly, most of the top 10 best trading days come immediately after the 10 worst trading days. Taking advantage of market drops has been historically fruitful!

Convexity In Chaos: A case study of FCX’s supply chain (a portfolio company & copper miner)

All non cited numbers are from the FCX 2021 10k

There are certain headlines that make an investor’s stomach churn in fear. One of those for us this month was the turmoil in Peru. A quick summary of events in the nation follows.

On December 7th, the Peruvian Congress was scheduled to vote on whether or not President Pedro Castillo should be impeached on corruption accusations. In response, the President attempted to dissolve Congress and install an emergency government. His plan was quickly thwarted, and he was arrested and kicked out of office. A few days later, his supporters took to the streets in violent protests; as the protests escalated, the government suspended the rights of assembly and freedom of transit.

Given all of this, we had to make a decision in regards to our copper company that derives 20% of its profit from a Peruvian mine. What might happen if the entire country was frozen by violence or riots?

In the event of a complete shutdown of Peruvian copper production, FCX would lose 20% of its profits. However, Peru is responsible for producing about 2.2M MT of the 21M MT of Copper produced globally. In the event that all Peruvian copper production was halted, the global output of copper would drop by around 10%.

Given a rough analysis of FCX, we estimate that if 20% of its profits were to disappear today, about a 30% increase in the price of copper would completely make up for this loss. Given these numbers, holding FCX is not an insane bet.

This simplifies our analysis, but it gets at the important point: in a ‘worst case scenario,’ we are betting on the convexity of commodities and commodity companies. By convexity, we mean a change in one thing resulting in a disproportionate change in something else. In other words, an asymmetric payoff.

For copper (because supply is so tight), a 10% decrease in supply can cause much more than a 10% increase in price. As a recent example from another commodity, Russia accounts for about 14% of global oil production… back in March, oil prices peaked at around a 30% increase from the day before the invasion of Ukraine. And remember, that was more of a perceived supply shock than anything: Russian oil is still selling, and India and China are still buying.

Framing on this example, a 30% increase in the price of copper in the event of a Peruvian production freeze is not guaranteed by any means, but it is certainly a possibility.

Moreover, the profits of the company itself are convex to an increase in the commodity price. If copper were to increase by 30% in value without the loss of the Peruvian income, the company’s profits would jump up to 50%; with the Peruvian mine offline, about 60% of that increase would be absorbed to cover fixed costs - the rest would bring profits back up to where they were before a shut down.

That being said, we do not think that there is a high chance of a total Peruvian standstill. Moreover, there are other mines in Peru that the population has a history of protesting - in other words, our company’s mine is not necessarily the first target.

Again, this is all simplification and rough modeling. However, the numbers are of high enough magnitude that we thought it was a good chance to illustrate a point: in relation to commodity price movements, the right companies can be antifragile - they can gain asymmetrically from world events, even world events that may seem like they would harm the company.

We’re not chasing companies that will 10x, but, if we find a company that we think is relatively robust, and happens to have this kind of positive exposure, we’re not often disappointed.

Seeing Through Chaos

Noah and I decided to take the unconventional personal risk last year of launching Noahs’ Arc. The immense support of the friends and family in the process has been humbling, but the whole journey has not been without its growth pains.

The above analysis is fun and quite powerful, but, we think it would be more powerful if we were able to follow Peruvian Twitter feeds in Spanish, or if we were able to track the frequency with which freighters and trains carrying our company's product were leaving Peru. Normally a large hedge fund would bring in Bloomberg terminals or data vendors that cost hundreds of thousands of dollars annually. We simply don’t have those resources (not yet!).

Unconventional problems require unconventional solutions. With this, Noah and I decided to launch a joint venture, focusing on AI investment research software to fill our needs and what’s turning out to be a strong need in the general market.

We’ve paired with another student-run hedge-fund, Squirl Financial, to launch Ultima Insights.

Ultima’s helping us do our job as fund managers better while turning it into a business of its own. At the heart of it, we are looking to automate parts of our investment research, such as our utilization of an alternative options pricing models, and, most significantly, by crafting a News Monitor that we hope in 2023 will process and analyze some of the data points above. We’re looking to have an MVP ready for that in the next week.

We’re very excited to continue developing tools that will help us see through the chaos into places we could only dream of 6 months ago and make us better investors because of it. Special thanks to the team at Ann Arbor Spark for agreeing to take Ultima into their accelerator and provide us with some startup grants.

The project is still a work in progress, but if you’re interested in hearing more about it, click here to check it out & hop on that newsletter, too. We would love to hear your thoughts on it, particularly if you are a professional in the investing and wealth management space.

As always, infinite thanks to all of you for reading and supporting us on our journey. Here’s to a 2023 that is less chaotic, but equally rewarding for when you rise to the challenges and prevail…

…such as when Michigan beats TCU today…

Go Blue!

Cheers,

Noah & Noah

No aspect of this material is intended to provide, or should be construed as providing, any investment, tax or other financial related advice of any kind. You should not consider any content herein or any subsequent services provided to be a substitute for professional financial advice. If you choose to engage in transactions based on the content herein, then such decision and transactions and any consequences flowing therefrom are your sole responsibility. Noahs’ Arc does not provide tailored investment advice to any person directly, indirectly, implicitly, or in any manner whatsoever.