Hey everyone! We hope you had a great memorial day weekend. Welcome to our second newsletter detailing our journey starting a private fund.

Disclaimer - By reading this newsletter, you understand that nothing included within is to be construed as investment advice. Everything is purely for informational purposes. We are not registered investment advisors or investment advisor representatives.

Executive Summary

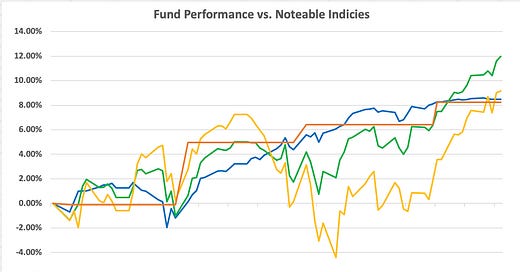

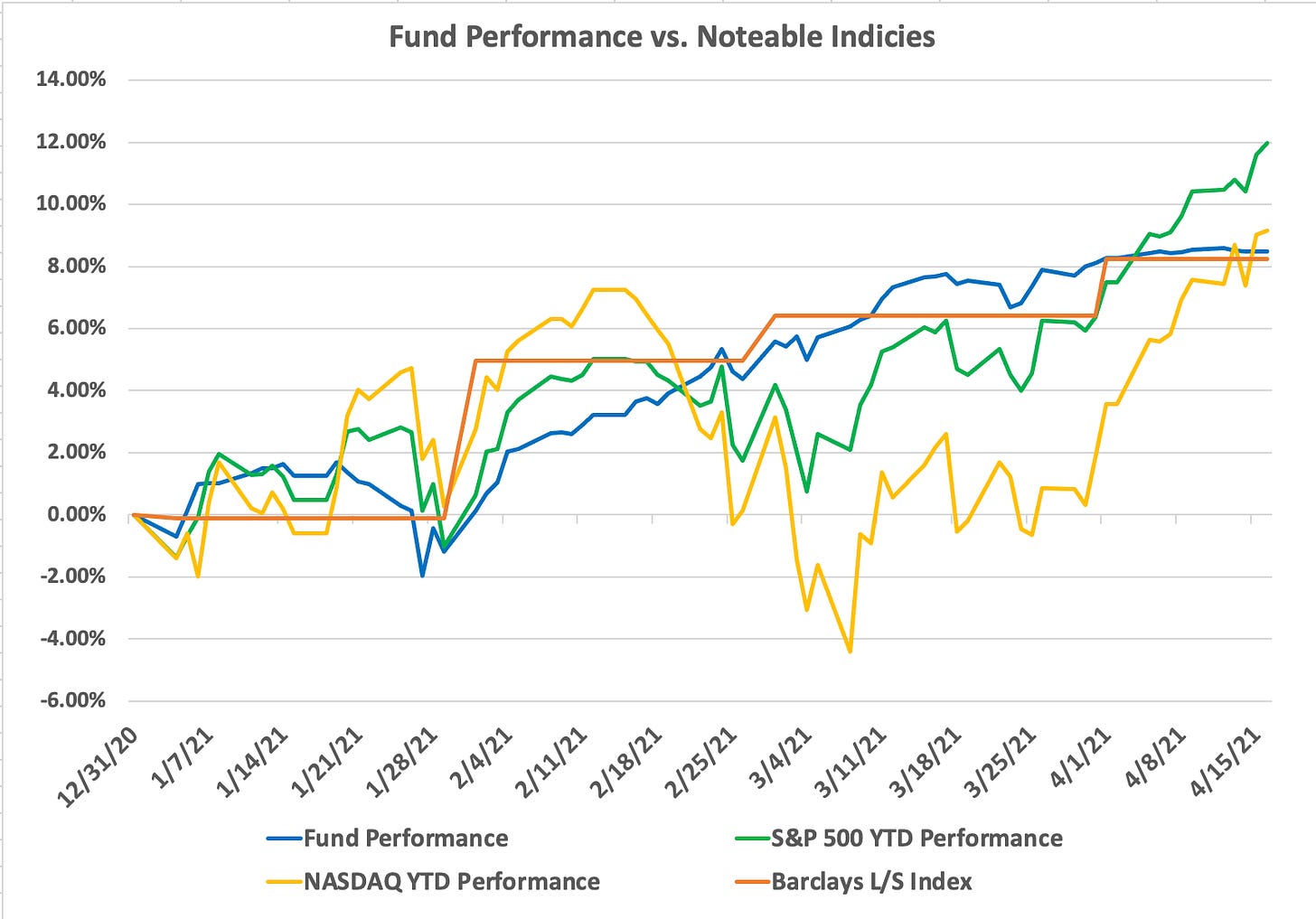

Performance Update: YTD, we have returned 8.48% on our investment. By mid-March, we had unrolled over 50% of our capital; by the end of April, we had completely exited the market.

Semiconductors: Semiconductors continue to remain in short supply. We discuss potential ends to the shortage, with a potential continuation of the supply crunch lasting as long as 2 years.

Looking ahead: We will resume our exercise in earnest in the Fall; until then, we discuss our summer plans.

Closing + Feedback: We ask for feedback; all is welcome, but we are particularly concerned with whether or not we’ve been more concise than we were in the Q1 update.

Micron Technology Research: We’ve attached our equity research report on Micron Technology, Inc, a stock we have been trading in and out of as part of our exposure to the semiconductor sector.

Performance

Past returns are not a guarantee of future yield.

We are fully aware that past returns are no indication of future yield on our strategy. We are also aware of the heightened variability caused by the short term nature of the data we are able to present. Still, we’ve been pleasantly surprised with overall performance in our test account, especially given that we began to unwind our positions back in March and had less than 50% of our original exposure by April - the above graph never adjusts for this reduction, but rather shows the return on the total amount of funds employed at the peak of the account.

If you haven’t already, you can read our last post for an overview of our strategy.

What are the other indices on the graph?

While you’re probably familiar with the S&P 500 and NASDAQ performances that we used to reference our own performance against above, you may not have heard of the Barclays Long Short Index. This is an index that compiles the returns of nearly 300 traditional long/short hedge funds (the line is flat because the value is calculated once a month - the last value shown is the return for all of April).

As is increasingly the case among investors, we’re skeptical of the effectiveness of the long/short model, especially after the short squeezes that started in January reminded the market of the true level of risk involved in the strategy; we’ll be sure to go more in depth about our thoughts on this strategy in the future, as well as how we think our own strategy is a response to it. As we’ve mentioned in the past, we haven’t officially selected a benchmark yet; however, this is a compelling indicator that we thought it would be interesting to include.

Why’d you unroll the investment account?

Noah C’s summer internship requires him to be financially focused exclusively on his work at Citigroup. We’ve both agreed this is a good time to temporarily pause the strategy and then change the account over to an official incubator fund in the fall. Learn more about our summer plans under “Looking Ahead.”

Semiconductor Outlook

Since the start of 2021, the semiconductor market has had extreme shortages due to an imbalance of supply and demand, stemming from increased need in many areas compared to a pre-pandemic environment and a ban against Chinese semiconductor producers begun by the Trump Administration and continued by the Biden Administration. This shortage is hitting automakers hardest with poor supply chain management and planning being held accountable. KPMG is estimating this could cost the industry $100 billion.

As COVID spread across the globe in March 2020, companies canceled semiconductor orders due to fears of a prolonged recession. Pain from canceled orders in the auto industry struck a chord among semiconductor manufacturers. As such, they quickly moved their production resources towards spaces that benefited immensely from the work from home trend, such as cloud computing.

However, as demand for Automobiles rebounded faster than expected, semiconductor supply was not able to catch up due to firms having reallocated production. Couple this with a surge in crypto related demand for GPUs, and the supply story looks bleak; Intel’s CEO believes the issue could take up to 2 years to resolve.

The final piece of the puzzle is the US pressure on the Chinese semiconductor maker SMIC due to their theft of intellectual property. In 2020, the US banned the sale of western made, high tech semiconductor manufacturing equipment to the conglomerate, crippling their ability to produce semiconductors and sending the market further out of balance.

So, how does this end? Well, it depends…

Adding semiconductor capacity is expensive and time consuming. By some estimates, it can take over 2 years to build a new foundry to make more chips; making matters worse, many of these foundries (or fabs, as they’re colloquially known), are by nature highly specialized and can only produce a limited scope of semiconductor types.

Of course, some industries like crypto currency mining are pulling back on demand due to falling prices dragging on profitability. Revenues from Bitcoin mining have fallen about 50% from when the currency was at $60k a coin and Ethereum gross profit margins have been more than cut in half. However, since crypto related demand is only part of the story, prices of semiconductor products (such as memory devices) can very well remain high to accompany the continuation of the supply shortage in the near to mid term. To round out our discussion of semiconductors, we’ve included our report on Micron Technology, a company we have traded in and out of as part of our semiconductor exposure.

Looking Ahead

You can expect 2 more newsletters from us this year, the next of which will be in late September. Until then, each of us have an exciting summer ahead!

Noah Cox will be joining Citigroup next week as a summer intern in the Treasury Trade Services division. In his free time, he plans on working on writing a book and brainstorming places to travel!

Noah Jacobs will begin studying to sit Part 1 of the Financial Risk Management exam this November. Additionally, he will continue writing and will spend some more time exploring the country, beginning with a Workaway opportunity in Maine this month.

Closing and Feedback

Thanks for reading, and please let us know if you have any feedback! Last time, we were told that we could be more concise - let us know if you think we’ve achieved that.

Cheers,

-The Noah’s